This is the recommended approach for S/4HANA (in Private Cloud and on-premise editions), and the only mechanism available for SAP S/4HANA Public Cloud. For the new features that SAP is developing in its systems, it is no longer (or soon will not be) possible to generate SAPScript printouts (e.g., SAP Note 3270781 for PIT-11 printouts in HCM).

Therefore, organizations using SAPScript or Smartforms should start planning to migrate to Adobe Forms. On the one hand, it will simplify the maintenance of systems – instead of three different technical approaches (SAPScript, Smartforms, Adobe Forms), we choose one: the most future-proof and the easiest to use. On the other hand – it will allow new system functions to be delivered to business users (where Adobe Forms are already the only available way to generate printouts).

ADS can be installed on an existing SAP NetWeaver Java system. If there is no SAP NetWeaver Java in the company’s environment, a separate system must be installed and connected to SAP. A separate license is not required.

Migration to ADS – our support

All for One Poland supports the migration to ADS by providing:

- implementation of any print forms from SAP in Adobe Forms technology on ADS;

- installation of SAP NetWeaver Java with SAP ADS along with configuration of connection with SAP; as well as maintenance (hosting) of SAP NetWeaver Java with SAP ADS.

- a set of preconfigured forms facilitating the transition to the new technology;

Currently, the package of preconfigured forms prepared by All for One focuses on the area of sales and distribution and includes the most important types of documents used in customer interaction. These are:

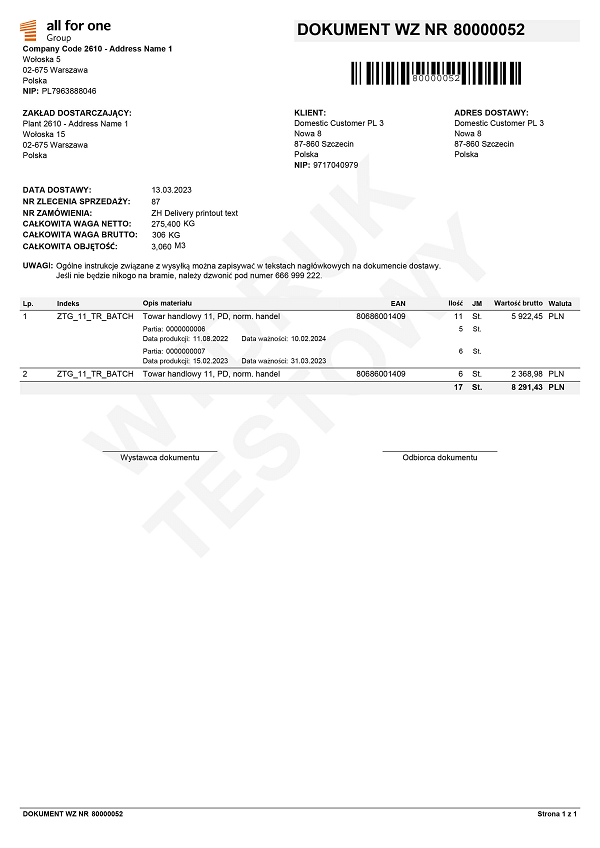

- Goods issue document (WZ);

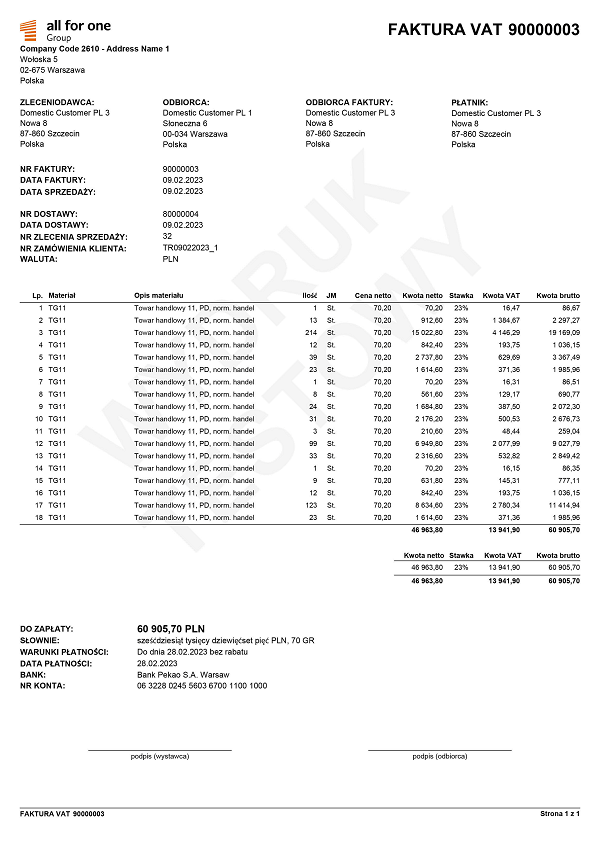

- VAT invoice;

- VAT invoice – value adjustment;

- VAT invoice – quantity adjustment;

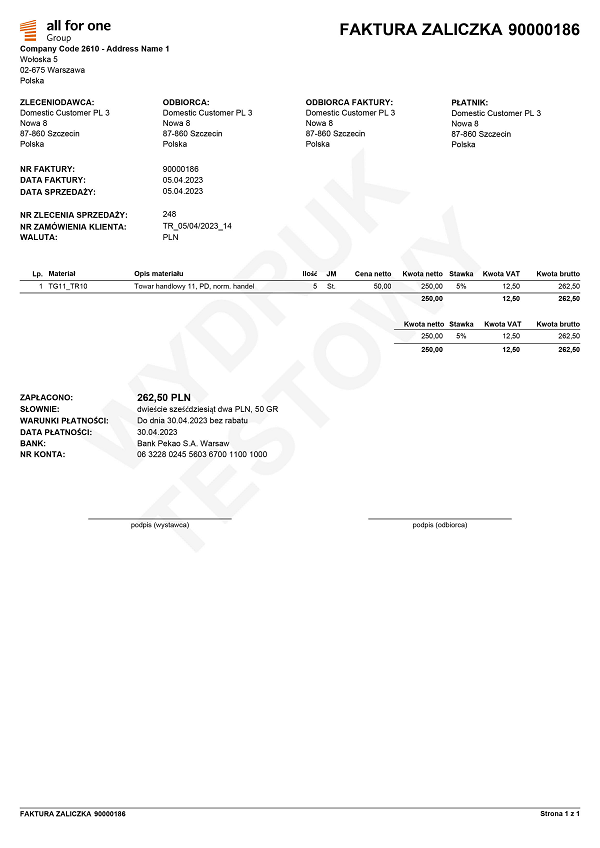

- VAT invoice – advance payment;

- VAT invoice – settlement of advance payment.

All forms are available in Polish and English (other language versions can be prepared upon request). There are plans to expand the package with forms from other areas of the system (materials management).

Examples of PDF forms from the All for One package prepared in ADS technology

- VAT invoice

- Advance invoice

- Material release document

Printouts of e-Tax Returns/PIT-11

The implementation of the new technology is the most urgent issue for the area of HR and e-Tax Returns/PIT-11. The form in Adobe for PIT-11 version 29 is the latest version released by SAP that allows the use of the withdrawn printing method via Smartforms. Each subsequent version will be supported solely through Adobe Document Services. The SAP note introducing Adobe forms for PIT and indicating the need to install the Adobe Document Service is note 3169544 – Version 29 of PIT-11 tax form for year 2022.

Why ADS?

The PDF format is the de facto standard for business forms. The introduction of Adobe Forms as the primary technology for generating printouts from SAP provides many benefits for customers. First of all, Adobe LifeCycle Designer (Form Builder), the primary tool for designing forms, is flexible and easy to use. In addition, it is fully integrated with SAP NetWeaver Developer Studio (Java) and ABAP Workbench.

It’s also worth mentioning some form editing options that our customers have repeatedly asked about. Forms can include graphic elements. Accepted formats include BMP, JPG, GIF, PNG and EXIF. No additional conversions are required to add an image. In addition, it is possible to import existing PDF or Word documents. All objects in the form (including texts) can be rotated. It is possible to use different page orientations (horizontal, vertical) within a single document.

Any TrueType fonts can be used in the design.

Barcodes can be printed on any Postscript, PCL, PDF or Zebra printers. Form objects are regular repository objects, with standard transport and versioning. The translation of forms is also easy.

The available SAP announcements and the visible direction of changes in relation to the SAP printout technology clearly indicate that Adobe Forms will change from being the preferred option to the only one. It is worth migrating to this tool today using the support provided by All for One Poland.