Generating SAF files from SAP – in accordance with the law

The Standard Audit File in SAP (SAF-T) is a solution from All for One proven in more than 250 companies. It enables you to prepare the SAP system for generating fiscal and accounting data in the SAF (Standard Audit File) form in accordance with the provisions of the new Polish Tax Ordinance Act.

We are developing and adapting the package to changing legal regulations, based on further information made available by the Ministry of Finance.

Our product is designed for SAP systems: S/4HANA Cloud Private; S/4HANA on-prem; SAP ECC/ERP version 6.0 or higher. If you use another SAP system or a system from another supplier, please ask us – we will offer an alternative solution.

On 1 July 2016 (for large taxpayers – with over 250 employees or annual turnover of at least EUR 50 million; for smaller companies – on 1 January 2017, the JPK_VAT file – a VAT purchase and sales register), the revised provisions of the Tax Ordinance Act on the manner of conducting tax audits came into force.

The Standard Audit File (SAF) became the evidence in control activities. This is a file with an agreed structure, in which a taxpayer is obliged to provide tax books and accounting documents at the request of the tax authority. If the documentation is not submitted according to SAF, the provisions of the Fiscal Penal Code will be applied as in the case of failure to provide evidence in paper form.

JPK VAT registration

- JPK_V7M (otherwise known as JPK_VDEK) – VAT registration with monthly declaration

- JPK V7K – VAT registration with quarterly declaration

JPK CIT (JPK_PD) registration

- JPK_KR_PD – accounting books/income tax

- JPK_ST_KR – fixed assets

JPK on demand

- JPK_KR – accounting books

- JPK_WB – bank statements

- JPK_MAG – a warehouse

- JPK_FA – VAT invoices

- JPK_FA_RR – VAT invoices – flat-rate farmers

- JPK_GV – Records of a VAT group member

All customers choosing our JPK package for SAP are provided with a set of ready-made functionalities together with the implementation methodology.

We also provide additional services:

- analysis of the scope of work necessary to meet the legal requirements in the company

- customization of the product according to the specific needs of the organization

As part of the maintenance service for All for One JPK, we provide our customers with updates and new versions at no additional charge.

This manufacturer’s support service is used by almost all companies that decided to purchase our SAF package for SAP.

New JPK CIT (JPK_PD) structures : JPK_KR_PD and JPK_ST_KR

In 2024, the Ministry of Finance introduced an additional annual obligation to mandatory SAF reporting using the new structures. In 2026, the reporting will apply to data for 2025, which means changes to SAP systems will have to be made as of January 1, 2025.

Prepare the system for January 1, 2025 and record business events according to the new guidelines. The first report for KAS will be due at the beginning of 2026, however only proper recording of events as of January 2025 will allow you to generate reports without concerns or errors.

To ensure accurate reporting in accordance with the new JPK CIT (JPK_PD) structures, it is necessary to include the following information in the accounting records, among others:

- Tax identification number of the counterparty, if assigned.

- For invoices that constitute accounting documents – the number identifying the invoice in the National System of e-Invoices if this number has been assigned.

- For individual accounts – tags identifying the content of economic operations recorded on these accounts, according to the tag dictionary.

- Data confirming the acquisition, manufacture or deletion of a fixed or intangible asset from records, including identifying the type of evidence of acquisition, manufacture or deletion, and the relevant dates.

- Indication of the types of business operations (and their values) to distinguish the differences between the balance sheet (UoR) and tax (CiT) approaches

All for One offers a package of services, including:

- Audit of the SAP system readiness in terms of accounting records consistent with the new JPK CIT structures: JPK_KR_PD (accouting books) and JPK_ST_KR (fixed assets).

- Implementation of necessary changes in SAP.

- Implementation of the JPK_KR_PD i JPK_ST_KR structures in the All for One JPK package, including adaptation to the customer’s specific records.

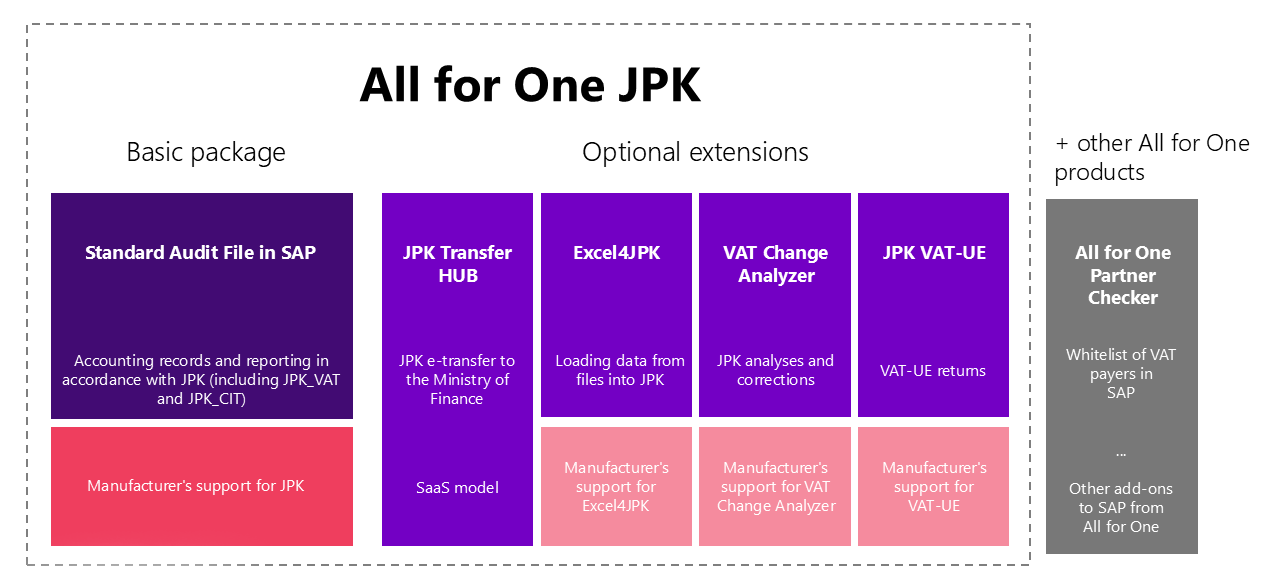

See All for One JPK package extensions

Check the additional features available in our package extensions. Automate processes, streamline the work of finance departments.

Excel4JPK extension enables automatic loading of data from external files to SAF.

The tool is used both to add new records to SAF (from outside SAP), and to modify records generated by the basic SAF tool, or to selectively remove selected records from SAF.

Basic functions:

- Management of file structures with configuration

- The ability to easily define validation rules for uploaded files

- Ability to generate master files from SAP transactions

- Loading MS Excel files/text files Uploaded data can be added to SAF, can be used to correct SAF records, and indicate records to be deleted

- Automatic integration with the SAF basic package

- Ability to automatically download loaded files when generating SAF data

- Ability to manually select loaded files when generating SAF data

The product can be used immediately after its installation in the SAP system. We provide user and administration instructions for the solution.

***

XML4JPK is an additional option that can be launched together with Excel4JPK. XML4JPK allows you to import any SAF-T files in XML format, regardless of the system in which they were generated.

The XML format is a standard for creating JPK files that is compatible with all accounting systems, including SAP and various independent solutions. This compatibility allows SAF-T files in XML format to be generated and read regardless of the system being used. This is especially beneficial during system migrations and when needing to submit corrections to SAF-T files for historical data.

The basic version of Excel4JPK requires using our internal template file, which must be completed each time. This limitation reduces its versatility when dealing with data from different sources. This requires adapting the data to our formats.

XML4JPK addresses the need for a more flexible solution by streamlining the process of generating JPK files. Customers can work with the complete range of SAF-T data without needing to format it in advance.

Basic functions:

- Import of ready-made XML files generated in various accounting systems

- Merging of multiple SAF XML files into a single coherent data set

- Ability to build a local SAF-T database based on XML files

- Transfer of complete SAF-T history between systems without data loss

The JPK Transfer HUB extension allows you to securely send data from SAP to the Ministry of Finance’s system in the format required by the new legislation, and provides a number of useful functions related to the electronic sending of SAF to the MF system.

Basic functions:

- Sending the SAF data to the Ministry of Finance gateway in a layout and format consistent with MF expectations

- Validation of the correctness of SAF file syntax

- Compressing SAF files

- Dividing SAF files into parts

- Encryption of SAF files

- Integration with qualified signature of SAF files

- Recording of individual events in the system and storing the Official Receipt Certificate (UPO)

- Monitoring the shipping process using the SAF shipping Monitor, directly in the SAP system (new transaction)

An additional option of All for One JPK is a functionality for automating analysis and correction of SAF files.

The regulations require accounting departments to regularly monitor prior periods and, if there is cause for adjustment, to correct them promptly (14 days).

In the event of finding an error or the reason for submitting a correction in the JPK_V7 file on one’s own, the entrepreneur is obliged to submit a correction of the SAF file within 14 days from the date of detection of the error in the submitted SAF file, detection of data showing inconsistent with the facts; or changing the data contained in the SAF file.

This option of our solution allows you to compare SAF statements for a given period, indicate the entries that require correction, and correct them automatically.

JPK VAT-UE extension enables automatic preparation of the VAT-EU declarations based on JPK files and preparation of the corrections.

Basic functions:

- Preparation of the basic VAT-EU recapitulative statement

- Preparation of the correction of the VAT-EU recapitulative statement (was/is)

- Automatic integration with the basic JPK package

Solution presentation

See how All for One JPK works